Written by James Edmonds

Over the past 17 years in UK Financial Services, I’ve come to understand how pivotal customer experience (CX) is to a company’s success. Meeting and exceeding customer expectations is a critical differentiator, especially in an industry where trust and loyalty are hard-earned. However, delivering outstanding CX isn’t a matter of chance: it requires the right skills, mindset, and processes embedded across the organisation. To achieve this, businesses need a structured framework to assess CX competency levels within their teams, ensuring they are equipped to drive meaningful improvements.

Defining CX Success

The first step in establishing such a framework is to clearly define what CX success looks like for your organisation. In financial services, there are some core competencies that are essential. These include customer empathy, regulatory knowledge, and data-driven decision-making. Customer empathy is essential for understanding client pain points and motivations. Regulatory expertise ensures CX initiatives comply with evolving financial regulations. Meanwhile, the ability to harness customer data effectively transforms raw feedback into actionable insights, driving both short-term wins and long-term growth.

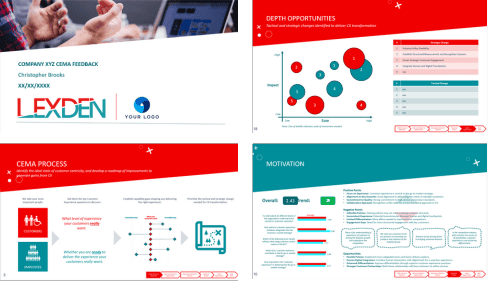

Leveraging CEMA for Comprehensive Assessment

A tool that’s instrumental in assessing CX competency is the Customer Experience Maturity Assessment (CEMA). I contributed to its development. CEMA provides an in-depth evaluation of a company’s readiness for CX transformation, assessing leadership engagement, team mindset, and capability. Incorporating CEMA into a competency framework helps organisations identify gaps and areas for employee development.” For instance, are senior leaders fully aware of their role in driving CX? Do front-line teams possess the necessary skills to support these initiatives? CEMA helps uncover these gaps and provides a roadmap for improvement.

A Structured Approach to Assessment

When you assess CX competency, it’s important to establish a structure that allows for a thorough yet practical evaluation. Combining self-assessment with manager evaluations ensures both individual perspectives and managerial insights shape a full view of team capabilities. Self-assessments help employees reflect on strengths and growth areas, while managers provide an objective view of customer-centric performance.

Linking CX Competencies to Business Performance

However, for a competency framework to truly add value, it must link skills to business performance. This is a core element in our CX Management training programme and a step everyone should complete. It’s essential to measure how CX competencies translate into key performance indicators (KPIs). Metrics like customer satisfaction (CSAT), Net Promoter Score (NPS), and First Contact Resolution (FCR) provide tangible data on how effectively teams are performing. For example, if a team struggles with quick issue resolution, this will likely be reflected in lower FCR scores, indicating the need for targeted training or process enhancements.

Continuous Improvement and Development

The real strength of a CX competency assessment lies in its capacity to drive continuous improvement. Once the initial evaluation is complete, the next step is to develop tailored training plans to address any skill gaps. This could involve workshops on empathy and customer engagement for some teams, while others may need more support in leveraging customer data. Mentoring and coaching programmes are also vital, particularly in financial services where regulatory demands add complexity to every customer interaction. By focusing on both the technical and emotional intelligence of employees, organisations can foster truly customer-centric teams.

It’s important to remember that assessing CX competencies shouldn’t be a one-off exercise. As customer expectations evolve, so too must the skills and knowledge of the teams serving them. Regular assessments help to ensure that skills remain sharp and aligned with the company’s strategic objectives. This ongoing commitment to skill development fosters a culture of continuous improvement, which is essential in industries like financial services, where customer trust and satisfaction are constantly being tested.

Conclusion

Building a framework to assess CX competency levels is critical for any organisation serious about delivering exceptional customer experiences. Throughout my time in the UK financial services sector, I’ve seen first-hand the importance of equipping teams with the right skills and tools to meet today’s customer demands. By defining key competencies, leveraging tools like CEMA, and implementing structured assessment processes, businesses can position themselves to meet the challenges of CX management head-on, resulting in happier customers, improved business outcomes, and a stronger competitive edge in a challenging market.